Group insurance is the simplest way to give your team real financial security and easy access to healthcare. Unlike individual policies, a group plan pools risk across your workforce, which is why it usually buys broader cover at a better price—and with far less admin. Think of it as the backbone of your benefits stack: health costs are contained, families have protection, and HR spends more time helping people than chasing paperwork.

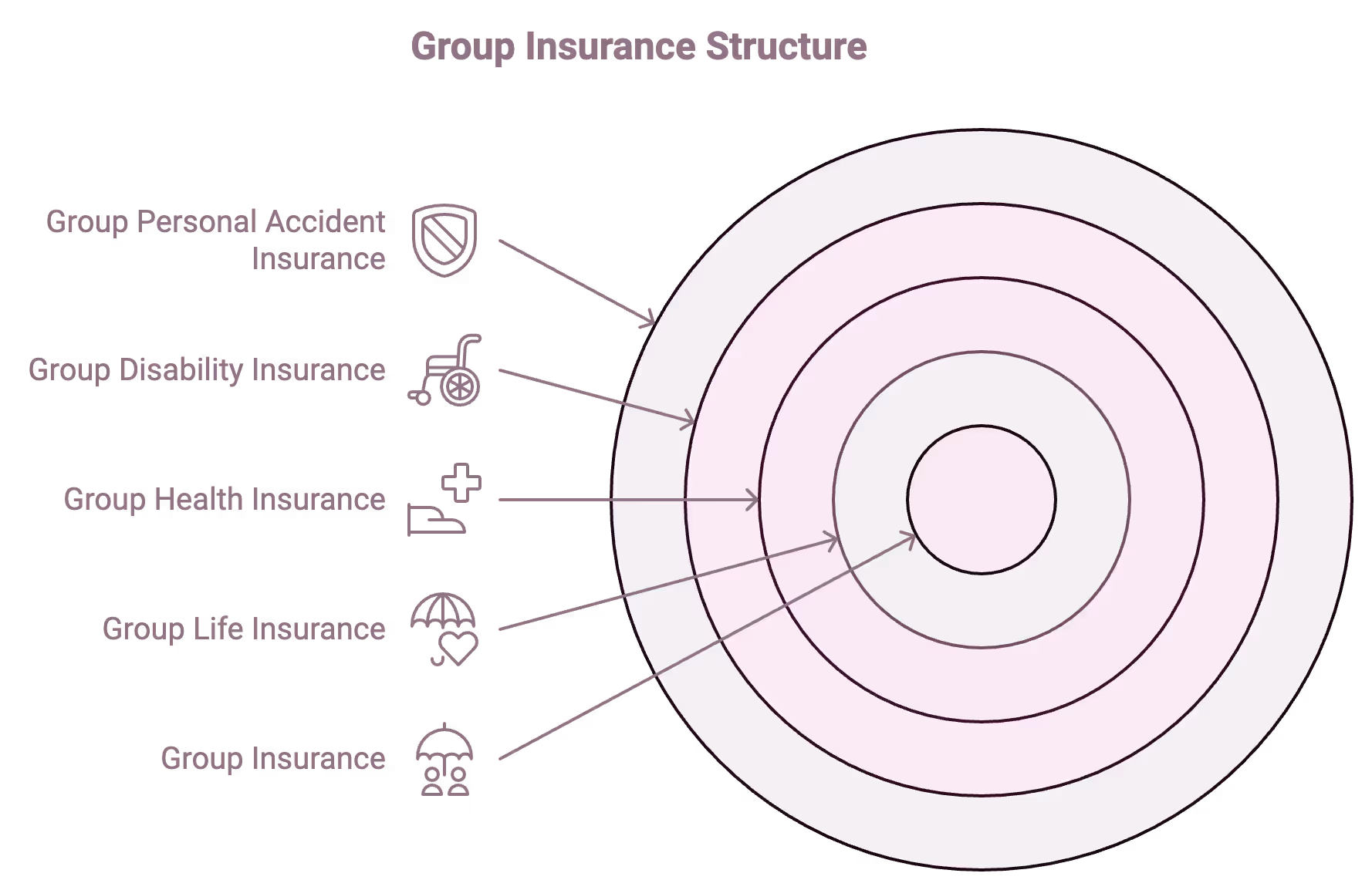

What is Group Insurance?

At its core, group insurance is a policy an organisation buys on behalf of its people. The company is the policyholder; employees (and often their dependants) are members under that “master” policy. Because premiums are pooled, you can negotiate richer benefits, smoother claims, and simpler servicing than employees typically get alone.

What a group plan often includes: comprehensive health insurance (Group Mediclaim/GMC), term life cover, personal accident insurance, and—in mature programs—telehealth, wellness, and preventive care. If you’re building your stack, start with health: Plum’s primer on Group Health Insurance lays out the moving parts, from cashless networks to reimbursement flows.

Group insurance plans can include:

Offering a group plan enhances employee well-being and supports retention, as employees value robust health and life benefits.

Group insurance also improves morale and productivity by promoting a sense of security.

{{group-insurance-quote="/web-library/components"}}

Detailed Cost Analysis of Group Insurance

When assessing group insurance, cost-effectiveness is one of its most appealing aspects.

Here’s a breakdown of the specific cost advantages group insurance offers over individual insurance, along with insights into any additional costs.

Group vs. Individual Insurance Costs

Group insurance typically comes at a lower cost than individual plans, primarily due to:

In comparison, individual plans are usually costlier because they account for each policyholder’s unique risks, health conditions, and coverage preferences.

Hidden Costs of Group Insurance

While group insurance offers many cost benefits, it’s essential to be aware of any additional costs:

Real-life Examples of Cost Savings

The cost benefits of group insurance have real-world implications for employers and employees alike. Here are a few examples:

These examples demonstrate how companies can offer quality benefits packages affordably while ensuring financial protection for their teams.

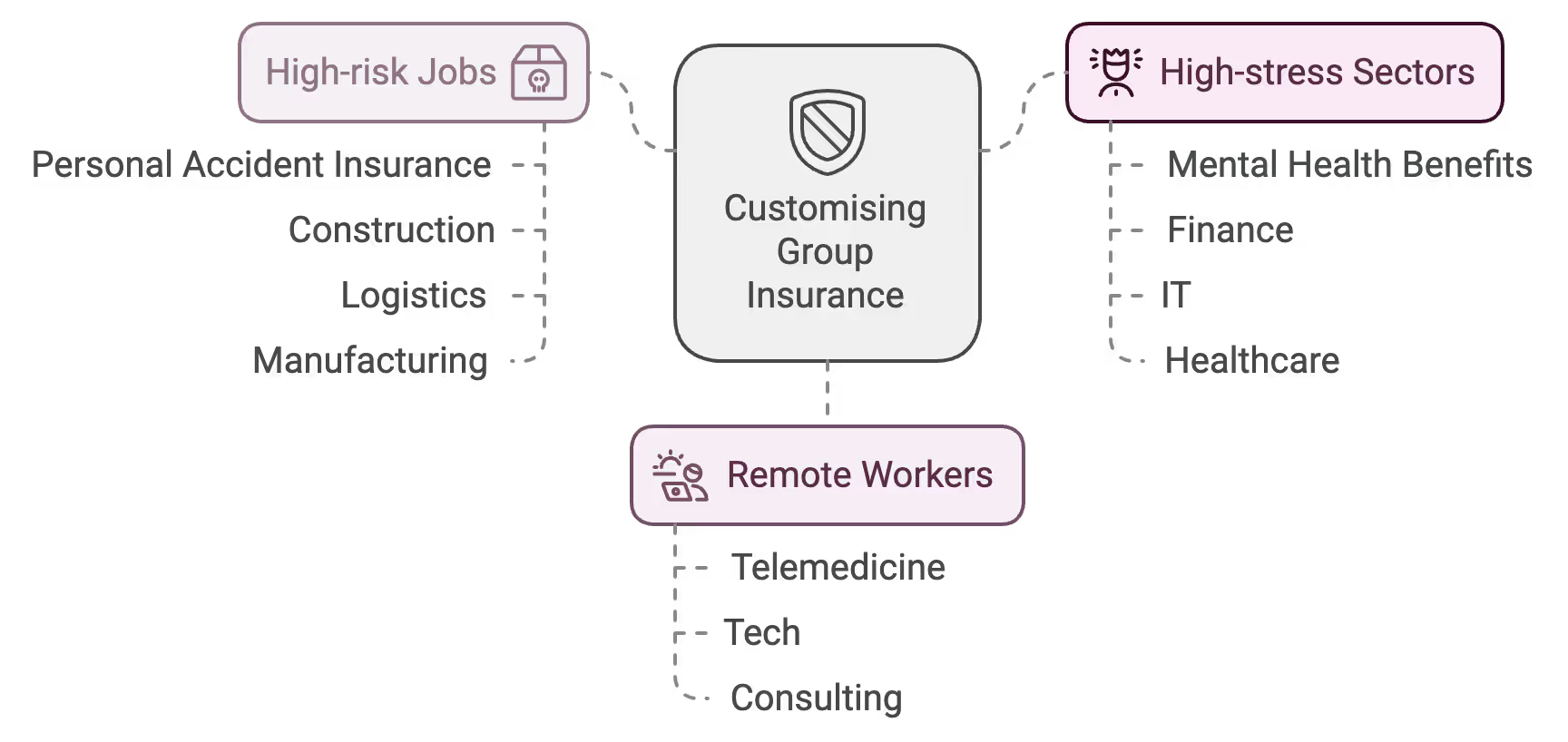

Comparison of Group Insurance Policies Across Industries

Each industry has unique challenges, risks, and needs, which influence the type of group insurance that will be most beneficial.

Customising group insurance based on industry can provide better protection for employees and align benefits with the demands of specific work environments.

Industry-specific Group Insurance Needs

Here’s how group insurance requirements typically vary across industries:

Tailoring coverage to specific needs not only provides better protection but also ensures the benefits are more meaningful for employees, enhancing engagement and loyalty.

{{group-insurance-quote="/web-library/components"}}

Customising Group Insurance Based on Industry Risks

Employers can customise their group insurance plans by considering industry-specific risks:

Market Trends in Industry-specific Group Insurance

With emerging industry needs, new trends are shaping group insurance:

By aligning group insurance plans with industry demands, organisations can offer targeted support that enhances employee satisfaction and addresses the unique risks each sector faces.

Detailed Exploration of Policy Terms & Exclusions

Understanding policy terms and exclusions is essential to make the most of group insurance benefits.

Exclusions define what isn’t covered, and recognising them helps employees avoid unexpected expenses and gives employers insight into any gaps in coverage.

Common Exclusions in Group Health Insurance

Most group health insurance plans contain certain exclusions, which may include:

Comparing Exclusions Across Group Insurance Types

Different types of group insurance come with their own exclusions, which vary by the insurance provider and the policy type:

{{group-insurance-quote="/web-library/components"}}

How to Mitigate Exclusions

Employees and employers can take steps to address exclusions and improve coverage:

By reviewing exclusions closely and exploring options to address them, employers can ensure that their group insurance plans provide maximum coverage and minimise out-of-pocket expenses for their employees.

Legal and Compliance Considerations for Group Insurance

Group insurance policies are subject to various regulations that protect employees’ rights and ensure transparency for employers.

For organisations, understanding these legal aspects is crucial to maintaining compliance and minimising liability.

Mandatory vs. Optional Coverage Requirements by Law

In India, group insurance plans must meet certain minimum standards and comply with regulations established by the Insurance Regulatory and Development Authority of India (IRDAI). Key aspects include:

Organisations should review these requirements regularly to ensure that their plans meet both legal standards and employee expectations.

GDPR & Data Privacy in Group Insurance

With group insurance, employers manage sensitive employee health and personal information.

Ensuring data privacy is essential, especially for companies with operations in regions like the EU that require compliance with the General Data Protection Regulation (GDPR).

Key practices include:

Compliance with data privacy regulations not only protects employee rights but also fosters trust and transparency within the organisation.

Navigating Regulatory Changes and Their Impact

As insurance regulations continue to evolve, companies must stay updated to avoid penalties and to keep providing compliant, high-quality benefits. Some common areas of regulatory change include:

Staying informed about regulatory updates and working closely with reputable insurers helps organisations remain compliant and provide employee benefits that align with legal standards.

{{group-insurance-quote="/web-library/components"}}

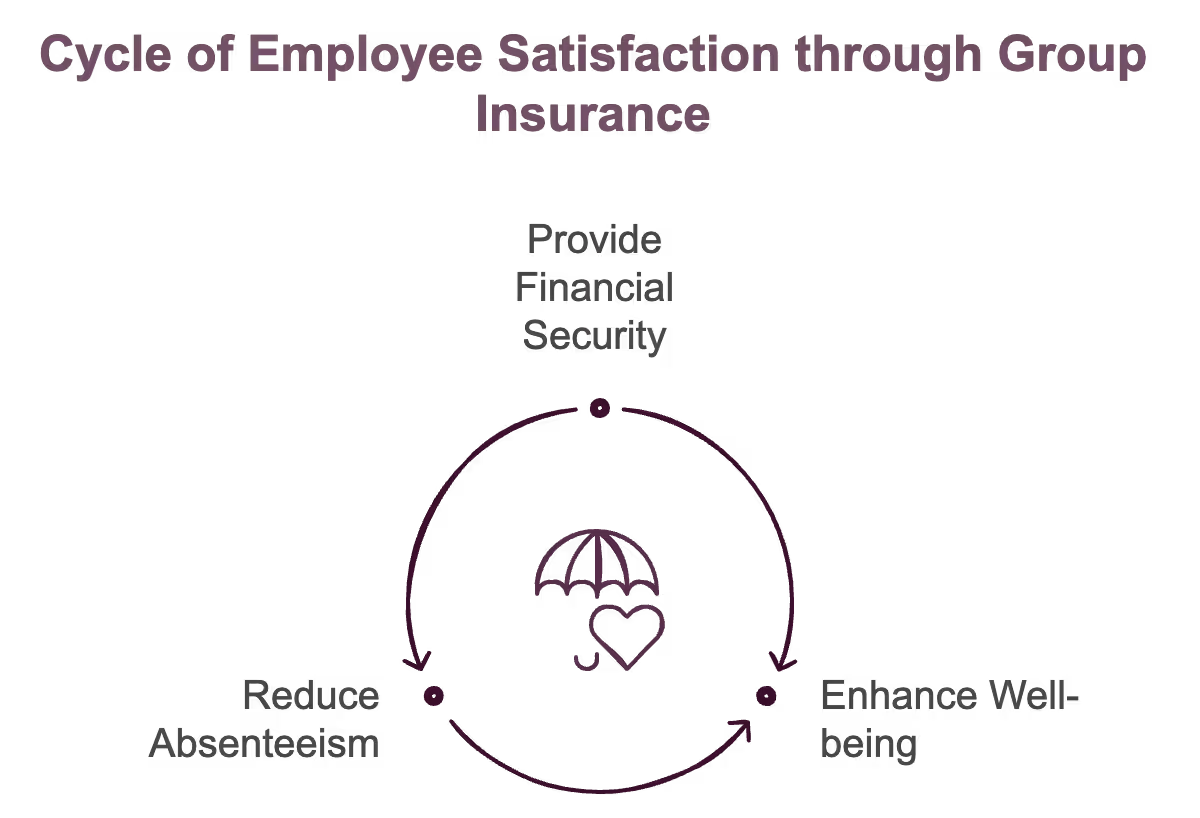

Deep Dive into Employee Benefits and Satisfaction Metrics

Providing group insurance is a key factor in improving employee satisfaction and loyalty.

In today’s competitive job market, comprehensive insurance benefits can be a deciding factor for talent recruitment and retention.

By ensuring that employees feel secure and valued, companies can foster a positive workplace environment, improve morale, and even boost productivity.

How Group Insurance Improves Employee Satisfaction

Offering group insurance contributes to employee satisfaction in several ways:

These benefits make employees feel valued, which in turn leads to a more engaged and productive workforce.

Case Studies: Impact on Retention and Recruitment

Real-world examples illustrate the advantages of group insurance in attracting and retaining talent:

These examples show how group insurance can help companies build a loyal, motivated workforce, adding to their overall value as an employer.

Comparative Analysis: Group Insurance vs. Flexible Benefits Packages

While group insurance is a popular option, some companies consider flexible benefits packages as an alternative.

Here’s a quick comparison:

Both approaches have their advantages, but group insurance remains highly effective for companies seeking affordable and comprehensive employee coverage.

{{group-insurance-quote="/web-library/components"}}

Portability & Conversion Options for Group Insurance

One of the common concerns with group insurance is what happens to coverage when an employee leaves the organisation.

Many group insurance plans offer portability and conversion options to ensure continuity of coverage, which can be especially valuable for employees with ongoing healthcare needs.

Understanding Group Insurance Portability

Portability allows employees to transfer their group insurance policy to an individual one, enabling them to continue their coverage outside the company’s plan. Key benefits of portability include:

To initiate the process, employees typically have a limited window (usually 30–60 days) after leaving the company to apply for portability with their insurance provider.

Costs and Considerations When Converting

Converting a group insurance policy to an individual plan can involve some costs and considerations:

For employees with significant healthcare needs, the continuity of coverage may be worth the additional cost.

However, it’s important to review plan details and explore ways to offset higher premiums, such as opting for a higher deductible or co-payment.

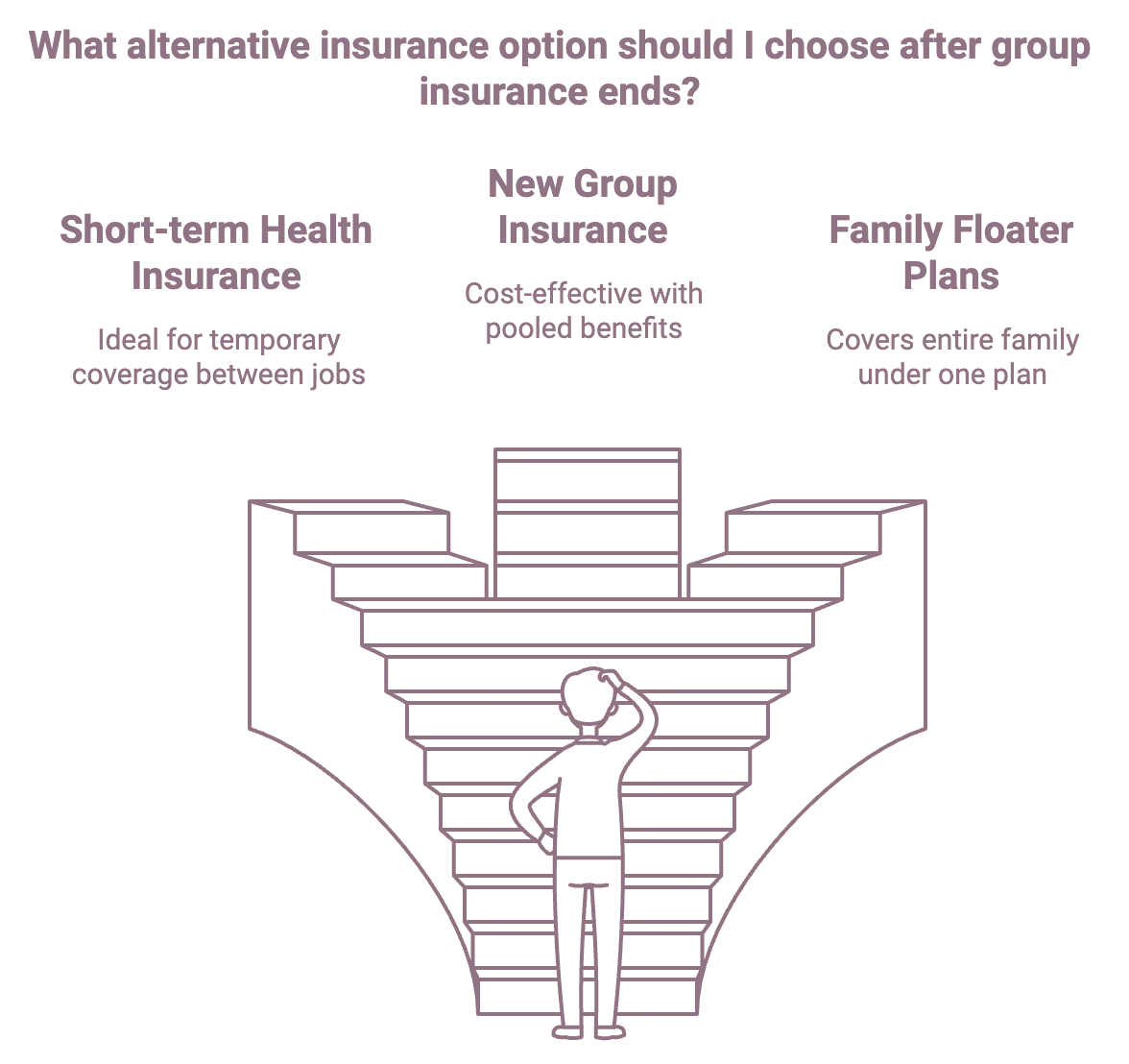

Alternative Options When Group Insurance Ends

If an employee doesn’t wish to convert their group insurance policy, there are other options to maintain coverage:

By understanding these options, employees can make informed decisions to ensure they remain covered, regardless of employment changes.

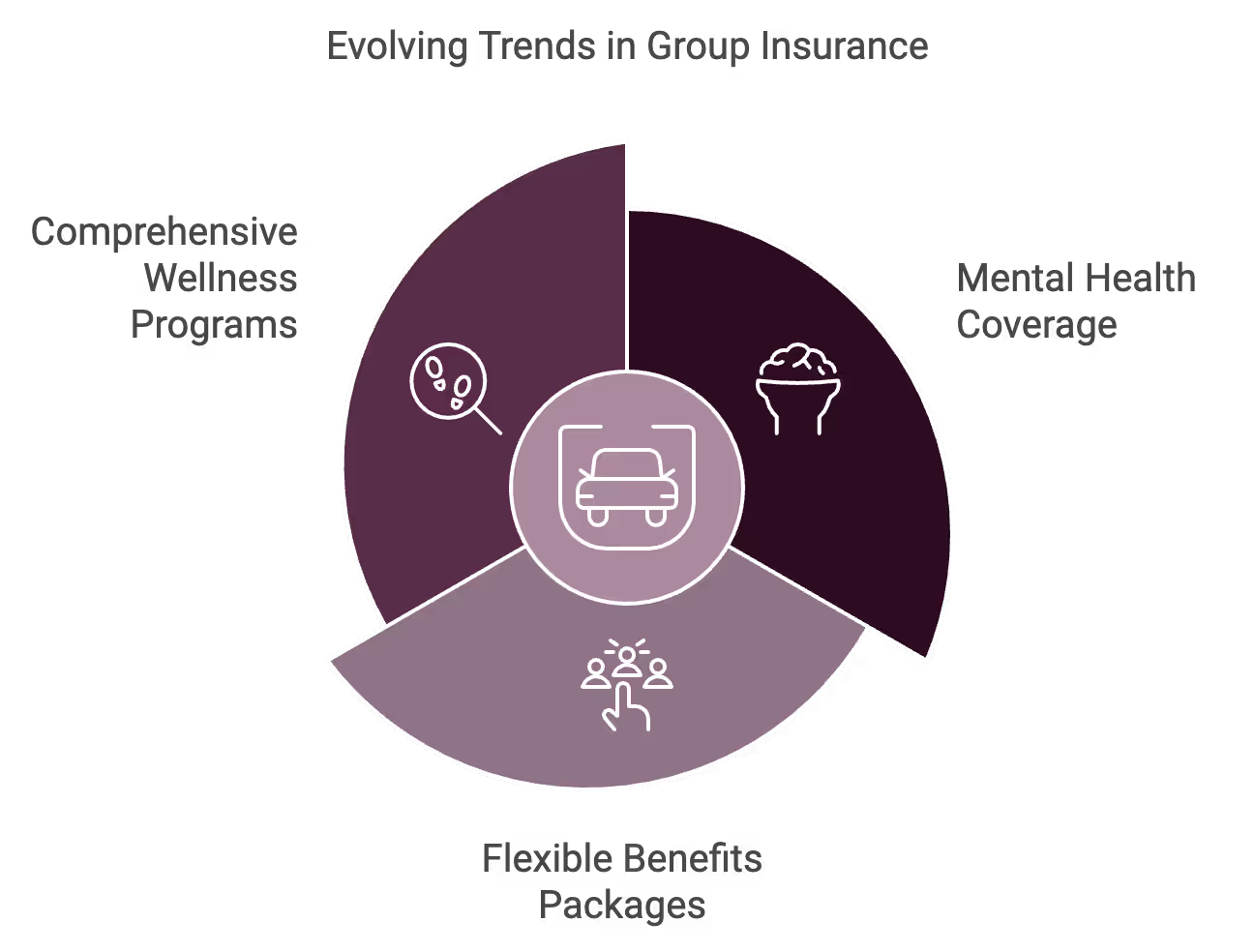

Global Trends in Group Insurance

As workplaces and employee needs evolve, group insurance trends are adapting to meet diverse requirements.

From flexible benefits and mental health support to technology-driven solutions, group insurance policies worldwide are becoming more comprehensive, personalised, and accessible.

International Comparison of Group Insurance Policies

Group insurance policies vary significantly across countries due to local regulations, healthcare systems, and cultural factors.

Here’s a look at some key differences:

Each region’s approach reflects the local healthcare environment and employee expectations, which helps organisations provide relevant benefits and ensure competitiveness.

The Future of Group Insurance

Emerging trends are reshaping group insurance, making it more adaptive to modern workforce needs.

Key trends include:

These advancements are transforming group insurance into a more dynamic and employee-focused benefit that goes beyond simple healthcare coverage.

Impact of Globalisation on Group Insurance Plans

Globalisation has influenced how organisations, especially multinationals, design and manage group insurance.

Key impacts include:

These trends highlight how globalisation is pushing group insurance providers to innovate, enabling companies to offer valuable, flexible, and culturally appropriate benefits to employees around the world.

{{group-insurance-quote="/web-library/components"}}

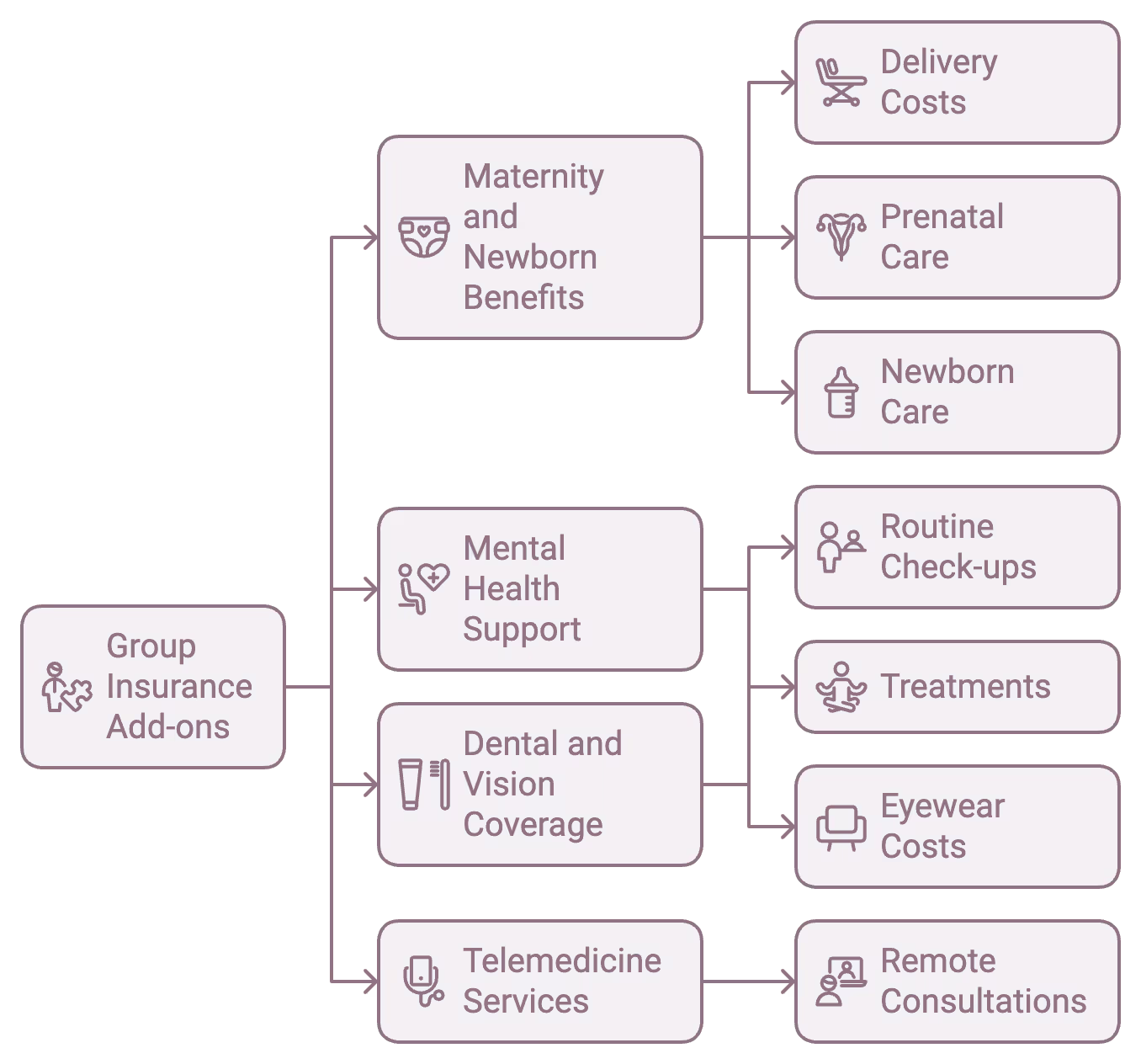

Customisable Group Insurance Plans & Add-ons

Customisation in group insurance allows organisations to offer a benefits package that meets the unique needs of a diverse workforce.

From add-ons like mental health support to super top-up options, customisable plans provide flexibility, helping employers create an inclusive and comprehensive benefits package that appeals to a wide range of employees.

Popular Add-ons in Group Insurance

Organisations are increasingly opting for add-ons that expand the scope of standard group insurance policies. Here are some popular options:

These add-ons make the plan more valuable to employees by covering areas often excluded from basic health insurance.

How to Customise Plans for Diverse Employee Needs

Customisation enables companies to tailor their group insurance plans to address the varying demographics and needs within their workforce:

By providing these options, organisations can support the specific needs of their teams, improving employee satisfaction and engagement.

Explaining Top-Up & Super Top-Up Options in Detail

Top-up and super top-up options allow employees to extend their coverage beyond the limits of their base group insurance. Here’s how they work:

These options allow employees to increase their coverage limits affordably and protect themselves against high medical expenses, giving peace of mind and financial flexibility.

{{group-insurance-quote="/web-library/components"}}

Frequently Asked Questions (FAQ)

Q: What is the difference between group insurance and individual insurance?

A: Group insurance covers a collective group (like employees of a company) under one policy, typically at a lower premium, as risk is spread across a large pool. Individual insurance, on the other hand, is tailored to a single person’s specific needs but often comes at a higher premium due to personalised risk assessment.

Q: How many members are required to buy a group insurance policy?

A: The minimum group size required for a group insurance policy can vary based on the provider and the type of policy. Many insurers offer group plans for as few as five members, making it accessible for small and medium-sized businesses as well.

Q: Is a group insurance policy transferable if I leave my job?

A: Yes, most group insurance policies offer portability options, allowing you to convert the group policy to an individual one. This can help maintain continuous coverage even after changing employers. Be sure to check with your insurer about conversion timeframes and any premium adjustments.

Q: Can part-time employees be covered under group insurance?

A: It depends on the organisation’s policy and the insurance provider. While some companies extend coverage to part-time employees, others may reserve it for full-time staff only. It’s best to clarify eligibility with your HR team or insurance provider.

Q: Are there specific add-ons that can enhance my group insurance coverage?

A: Absolutely. Popular add-ons include mental health support, maternity and newborn benefits, dental and vision cover, and telemedicine services. These add-ons provide added support and allow employees to tailor coverage to better fit their personal needs.

Q: What is the difference between top-up and super top-up plans?

A: Both top-up and super top-up plans offer additional coverage once your base policy’s limit is exhausted. However, a top-up plan activates only after each claim crosses a set threshold, while a super top-up applies the threshold just once over multiple claims in a policy period. This makes super top-ups ideal for people expecting multiple claims in a year.

Q: What factors affect group insurance premiums?

A: Premiums are influenced by the group’s size, age distribution, industry risk level, and past claims history. Larger groups tend to have lower premiums due to risk pooling, while high-risk industries may face higher premiums.

Q: Is group insurance taxable?

A: Group insurance premiums paid by employers are often tax-deductible as a business expense, depending on local tax laws. Employees may also receive tax benefits on the portion they contribute. It’s advisable to consult a tax advisor for specific guidance based on individual circumstances.

Q: What happens to my group life insurance coverage after I retire?

A: Generally, group life insurance coverage ends upon retirement or when an employee leaves the organisation. However, some policies may offer the option to convert to an individual plan to continue coverage after leaving the group. Reviewing the policy terms before retirement can help you plan for continuous protection.

Q: Can group insurance policies cover dependents?

A: Yes, many group health insurance plans allow coverage for dependents, such as spouses, children, and sometimes even parents. Organisations may offer dependent coverage as a standard benefit or as an optional add-on for employees to select.

Q: What wellness programs are commonly included in group health insurance?

A: Wellness programs in group health insurance often include preventive check-ups, fitness classes, mental health resources, and lifestyle management services like nutrition counselling. These services aim to support employees’ overall well-being and reduce future medical expenses by promoting a healthier lifestyle.

.avif)

.avif)